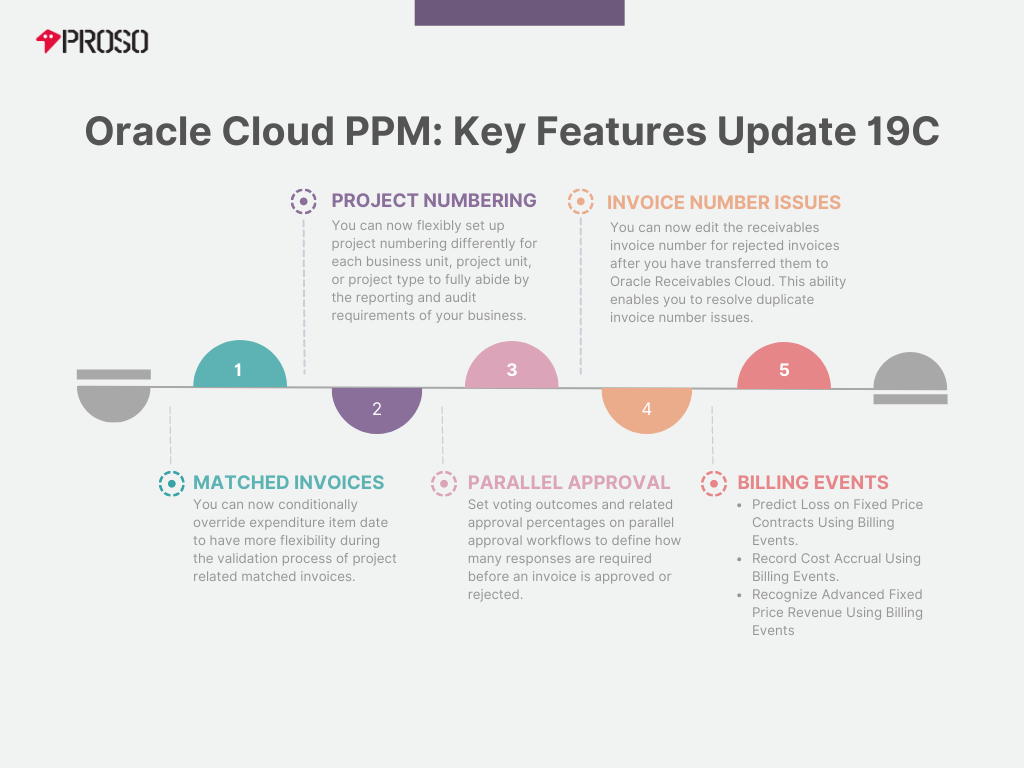

Oracle Cloud PPM – Key Features Update 19C

Oracle Cloud PPM – Key Features Update 19C

Oracle Cloud Applications delivers new updates every quarter. This means every three months you’ll receive new functionality to help you efficiently and effectively manage your business. Some features are delivered Enabled meaning they are immediately available to end users. Other features are delivered Disabled meaning you have to opt in for them.

19 C quarterly release introduced some of the key features in the areas of Project Foundation, Project Costing and Project Billing. Let’s look at some of them briefly and understand how these enhancements would help business users work efficiently and effectively.

Summary:

- Conditionally Override Expenditure Item Date for Matched Supplier Invoices

You can enable this feature to have more flexibility during the validation process of project related matched invoices.

Expenditure Item Date derivation is based on the profile value set, for the profile “Specify Default Expenditure Item Date for Supplier Cost Transactions”, from the below options

- Transaction accounting date

- Transaction creation date

- Transaction date

- Source document expenditure item date

When this feature is enabled and your invoice expenditure item date derived from the profile value set is outside of the project finish date, task transaction finish date or award end date, the expenditure item date in the invoice line will be overridden to the earliest end date among the project finish date, task transaction finish date, or award end date.

Thus, this feature helps override expenditure item dates that are otherwise would have failed in transaction control validation process.

Flexibly Set Up Automatic Numbering for Projects

With this feature, you can set up the project numbering by one of the following dimensions

- Project Unit

- Business Unit

- Project Type

With additional flexibility to configure project numbering differently for each business unit, project unit, or project type, fully abide by the reporting and audit requirements of your business.

If you don’t need complex setup for project numbering, you can choose to go with a default manual or automatic project numbering model for all your projects.

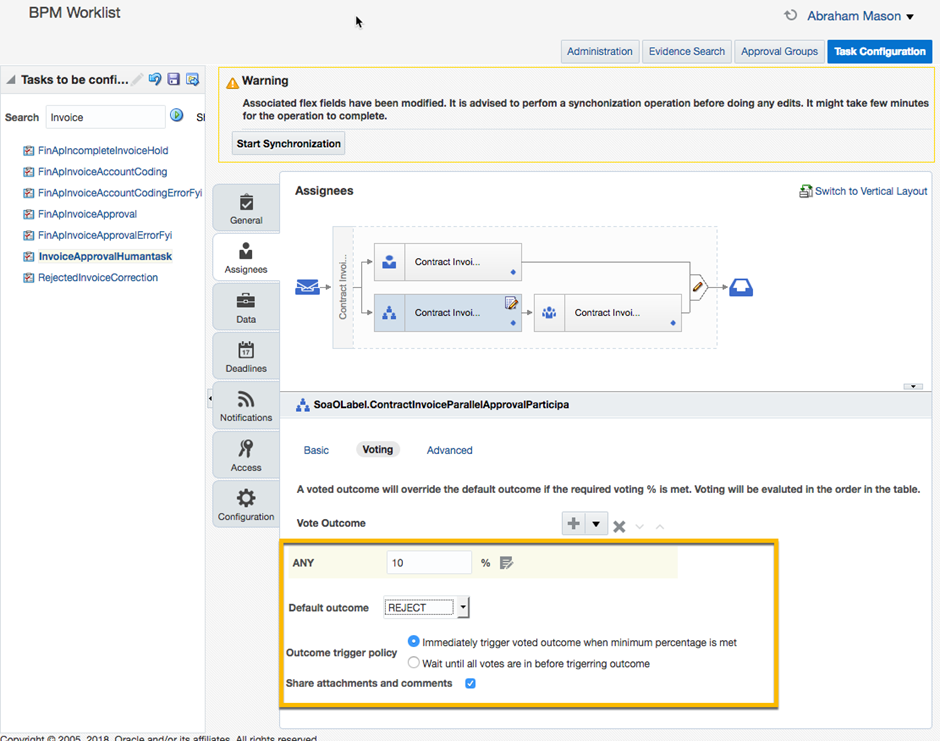

Set Voting Percentage and Outcomes on Parallel Approval

Set voting outcomes and related approval percentages on parallel approval workflows to define how many responses are required before an invoice is approved or rejected. The settings enable you to configure approval workflows to meet your specific business requirements.

Prior to this enhancement, approval groups required a 50% approval of the group to approve with no ability to edit. As a result, if a group included 5 individuals, three users (surpassing 50% of all users in the group) would need to approve the invoice before the invoice is approved by the group. However, in many cases you may want a different rule for group, you can now take advantage of the additional options by navigating to the Voting tab of a parallel approval Assignee as shown in the screenshot.

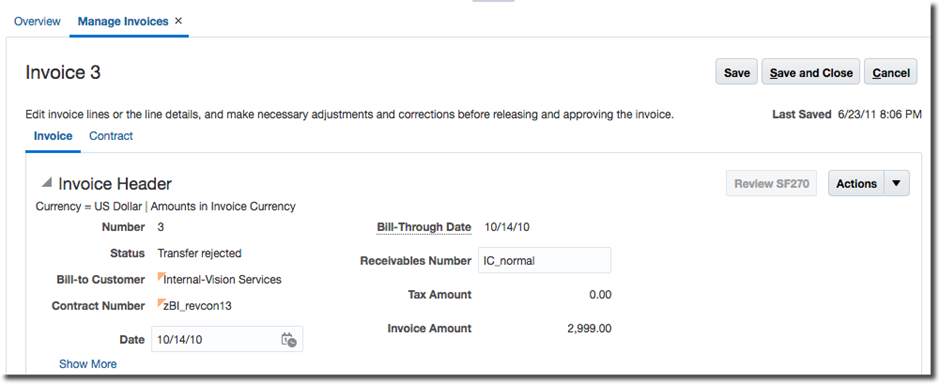

Edit Receivables Number on Transfer Rejected Invoices

Edit the receivables invoice number for rejected invoices after you have transferred them to Oracle Receivables Cloud. This ability enables you to resolve duplicate invoice number issues. Once enabled, transfer rejected invoices will now have the option to edit or regenerate the receivables number as shown below.

Predict Loss on Fixed Price Contracts Using Billing Events

Define business-specific calculations to create billing events to accrue predicted losses on fixed price contracts using the project process configurator.

Accounting standards require you to accrue the full estimated loss on fixed price contracts in the current accounting period that the estimated loss is calculated. To achieve the automatic loss accrual, you can configure multiple sets of rules to create revenue-applicable billing events that can be accounted as loss accruals. These sets of rules are called project process configurators.

When you assign these project process configurators to a revenue method, select the revenue method on a revenue plan, assign the revenue plan to a contract line, and run the Generate Revenue process, the application automatically creates revenue-applicable billing events. When you run the Create Accounting process for the applicable contract business unit, the revenue-applicable billing events create and post accounting entries in your general ledger that accrue the estimated losses on fixed price contracts to an expense account on your income statement. This feature lets you accurately report corporate level profitability, while ensuring you don’t overstate project contract revenue in project subledger.

Record Cost Accrual Using Billing Events

Define business-specific calculations that create billing events to record cost of goods sold using the project process configurator.

To automatically transfer cost from work-in-process to cost of goods sold, you can configure multiple sets of rules to create revenue-applicable billing events that can be accounted as cost transfers. These sets of rules are called project process configurators. When you assign these project process configurators to a revenue method, select the revenue method on a revenue plan, assign the revenue plan to a contract line, and run the Generate Revenue process, the application automatically creates revenue-applicable billing events. When you run the Create Accounting process for the applicable contract business unit, the revenue-applicable billing events create and post accounting entries in your general ledger that transfer cost from the Project Work-in-Process to the Project Cost of Goods Sold account. This feature lets you accurately report corporate level profitability, while ensuring you don’t overstate project contract revenue in project subledger

Recognize Advanced Fixed Price Revenue Using Billing Events

Define business-specific calculations that create billing events to record cost of goods sold using the project process configurator.

To automatically transfer cost from work-in-process to cost of goods sold, you can configure multiple sets of rules to create revenue-applicable billing events that can be accounted as cost transfers. These sets of rules are called project process configurators. When you assign these project process configurators to a revenue method, select the revenue method on a revenue plan, assign the revenue plan to a contract line, and run the Generate Revenue process, the application automatically creates revenue-applicable billing events. When you run the Create Accounting process for the applicable contract business unit, the revenue-applicable billing events create and post accounting entries in your general ledger that transfer cost from the Project Work-in-Process to the Project Cost of Goods Sold account. This feature lets you accurately report corporate level profitability, while ensuring you don’t overstate project contract revenue in project subledger.

We’ll look at some of these new features e.g. Project Process Configurator is greater. Details soon.

Keep Learning! Keep Exploring What you have Learned!